capital gains tax proposal canada

The origin of capital gains taxation in Canada can be traced to the Carter commission appointed in September 1962 to thoroughly review the Canadian tax system. NDPs proto-platform calls for levying.

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

The NDP has also pledged to increase taxation on capital gains to 75.

. Has an estate tax the exemption was raised beginning in 2018 to estates worth US112 million Canada has no inheritance tax aside from provincial probate and the deemed disposition on death. A Capital Gains Tax On Real Estate. Drafter123 iStockphoto.

Multiply 5000 by the tax rate listed according to your annual income minus any. The proceeds of disposition. In 1966 the commissions report recommended among other things that a tax be imposed on capital gains.

The draft legislation includes measures first announced in the 2022 Federal Budget with updated versions of draft. This means that if you earn 2000 in total capital gains then you will pay 53520 in capital gains tax. 1 day agoOn August 9 2022 the Canadian federal government released a package of draft legislation to implement various tax measures update certain previously released draft legislation and make certain technical changes Proposal.

Because you only include one-half of the capital gains from these properties in your taxable income your cumulative capital gains deduction is 446109 half of 892218. For dispositions of qualified farm or fishing property QFFP in 2021 the LCGE is 1000000. The top marginal income tax rate for individuals trusts and estates would be increased to 396.

To calculate your capital gain or loss you need to know the following 3 amounts. Your capital gain is 5000. The Ways and Means Proposal would increase the top marginal corporate income tax rate to 265.

The 500 will need to be added as taxable income and youll. The income is considered 50 of the capital gain. A federal NDP campaign promise to increase the capital gains inclusion rate to 75 from 50 would bring in 447 billion over the next five years according to estimates released by the Parliamentary Budget Office.

For example if you sold an asset for 2000 that has an ACB of 1000 the taxable income is 500. The party released the PBOs costing of its campaign platform on Saturday. The tax brackets for each province vary so you may be paying different amounts of capital gain tax depending on which province you live in.

The total amount you received when you sold the shares was 5000. The Proposals introduce a new rule that would apply in lieu of subsection 13253 to limit deductions claimed in. Thus ETFs can realize large amounts of capital gains in connection with such redemptions but under subsection 13253 were left without an effective method of eliminating the double taxation associated with such capital gains.

The Greens would increase the inclusion rate to 100. In Canada the taxable capital gain must be reported as income on your tax return for the year the asset was sold. The recent passage of Bill C-208 exacerbates these issues.

The adjusted cost base ACB the outlays and expenses incurred to sell your property. On a capital gain of 50000 for instance only half of that amount 25000 is taxable. The effective capital gains tax rate in Canada is 50 of your marginal tax rate.

Candidates and their political parties are proposing several changes to the current tax schemes. When you sold the 100 shares this year you received 50 per share and paid a 50 commission. The commission acknowledged that the taxation of.

And the tax rate depends on your income. The capital gains tax rate in Canada can be calculated by adding the income tax rate. 1000 gain x 50.

To calculate your capital gain or loss subtract the total of your propertys ACB and any outlays and expenses incurred to sell your property from. The long-term capital gains rate would be increased to 25 for transactions taking place on or after Monday September 13 2021. Canada is one of the few countries that doesnt have a capital gains tax on a households primary residence.

To fix these problems the inclusion rate for capital gains should rise to 80 per cent from the current 50 per cent. The capital gains tax rate in Ontario for the highest income bracket is 2676. If you earned a capital gain of 10000 on an investment 5000 of that is taxable.

The proposal is so unpopular with voters that when a senior bank economist suggested in a research paper earlier this year that the principal residence exemption from capital gains tax be reviewed. The New Democratic Party NDP in. The current tax preference for capital gains costs 35 billion annually with high-income families accruing most of the benefit.

Look Ventilator Hack From Canada Genius Doctor Transforms 1 Ventilator To 9 Healthcare Channel Hospital Technology Updates Turn Ons

Get Gsa Schedule 70 It Goods And Services

Retailers Fiscal Future Laws Regulations Content From Supermarket News The American Taxpayer Relief Act Flow Chart Data Visualization Infographic Fiscal

Retailers Fiscal Future Laws Regulations Content From Supermarket News The American Taxpayer Relief Act Flow Chart Data Visualization Infographic Fiscal

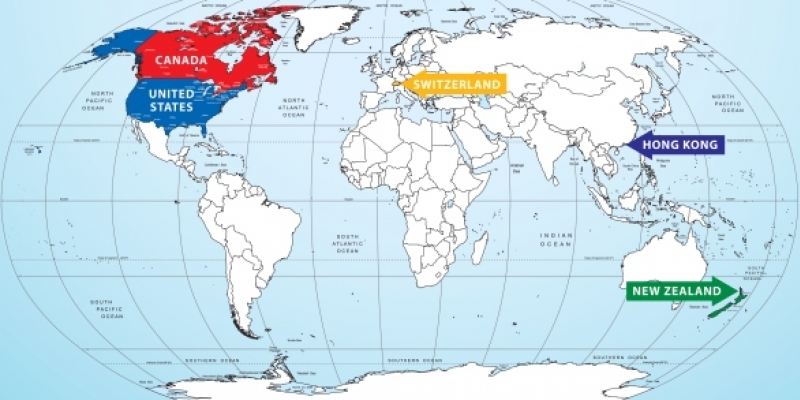

Capital Gains Tax Reform In Canada Lessons From Abroad Fraser Institute

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

Marginal Tax Rates For Each Canadian Province Kalfa Law

Irs Tax Forms Form 1040 Schedule C Schedule E And K 1 For Business Irs Tax Forms Irs Taxes Tax Forms

Black Pen On W8ben Tax Form Stock Photo 786362671 Shutterstock

High Income Earners Need Specialized Advice Investment Executive

Pin By Oksana On Business Business Investors Schedule How To Plan

Editable 40 Cost Benefit Analysis Templates Amp Amp Examples Templatelab Cost Impact Business Impact Analysis Advertising Costs

Apecoin Community Votes On Keeping Ape Token In The Ethereum Ecosystem Altcoins Bitcoin News

Free Investment Property Calculator Spreadsheet

Challenging Books In Library Study To Rise In 2021 In 2022 Books History Lessons Education Reform